Anyone Thinking of Investing in Oil?

- Thread starter Djshorty89

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Oil is Deeply Controlled

If you go way back and see the manipulation in this needed commodity, there are hidden forces pulling the strings.

Just like the prices of Gold and Diamonds are carefully controlled to prevent certain people from knowing the truth.

Right now, too many people are involved in the oil business and that is not good for the powers that be. The way you take control of an industry is to drive prices so low that most competition would just go out of business.

Rockefeller used the same tactics in the early days of the oil business; J P Morgan used it during the early days of the steel business.

For the recent oil price slide, I see two forces that might be at play:

The house of SAUD decided to increase production.

The West especially America is suspicious of the growing boldness of PUTIN. Before the oil slide, Russia was accumulating so much money in foreign reserves that alarm bells started ringing in some hidden spy agencies.

Recently China, Russia, Brasil, India and South Africa, formed a money union called BRICS - Here is a good article for those not in the loop.

The Biggest thing America fear the most is the removal of the dominant power of the DOLLAR in world trade. Momar Qaddafi was killed for ditching the dollar. Go do your research if in doubt.

Brazil is experiencing some trouble with the recent slide of commodity prices.

Russia is in trouble as the RUBLE slides further into third world status.

Could cite more evidence of trouble forthcoming for those that participated in the new money union.

The recent oil slide is a well orchestrated drama to reduce the number of open oil rigs, while also dealing a substantial blow to former foes like Russia.

If you do not see the connection between Geo-politics and oil prices, then you must not see the silent agreement between Google and big business.

Will the oil price slide continue? Only time will tell, but I know the major oil companies are not losing any money.

My research and gut tells me the slide is designed to bring certain countries that have accumulated huge foreign reserves back into the control grid.

The DOLLAR will eventually be replaced as the dominant currency, but not without War and bloodshed.

So what will be the new dominant currency? The opening salvo to determine that is part of the slide in oil prices.

If you go way back and see the manipulation in this needed commodity, there are hidden forces pulling the strings.

Just like the prices of Gold and Diamonds are carefully controlled to prevent certain people from knowing the truth.

Right now, too many people are involved in the oil business and that is not good for the powers that be. The way you take control of an industry is to drive prices so low that most competition would just go out of business.

Rockefeller used the same tactics in the early days of the oil business; J P Morgan used it during the early days of the steel business.

For the recent oil price slide, I see two forces that might be at play:

The house of SAUD decided to increase production.

The West especially America is suspicious of the growing boldness of PUTIN. Before the oil slide, Russia was accumulating so much money in foreign reserves that alarm bells started ringing in some hidden spy agencies.

Recently China, Russia, Brasil, India and South Africa, formed a money union called BRICS - Here is a good article for those not in the loop.

The Biggest thing America fear the most is the removal of the dominant power of the DOLLAR in world trade. Momar Qaddafi was killed for ditching the dollar. Go do your research if in doubt.

Brazil is experiencing some trouble with the recent slide of commodity prices.

Russia is in trouble as the RUBLE slides further into third world status.

Could cite more evidence of trouble forthcoming for those that participated in the new money union.

The recent oil slide is a well orchestrated drama to reduce the number of open oil rigs, while also dealing a substantial blow to former foes like Russia.

If you do not see the connection between Geo-politics and oil prices, then you must not see the silent agreement between Google and big business.

Will the oil price slide continue? Only time will tell, but I know the major oil companies are not losing any money.

My research and gut tells me the slide is designed to bring certain countries that have accumulated huge foreign reserves back into the control grid.

The DOLLAR will eventually be replaced as the dominant currency, but not without War and bloodshed.

So what will be the new dominant currency? The opening salvo to determine that is part of the slide in oil prices.

Related to the OP: I am underwater in some Frakking related stocks and I am not sure how I am going to play it. I might capitulate on Monday because I do think there is a chance at another leg down. However the stocks I own pay a strong dividend and I am looking a nice yield to try to wait it out. But, of course, if the bloodbath in crude $ continues I expect dividends to be slashed or suspended entirely.

I walked into this a little bit so I am pissed at myself. I raised some cash last week and shorted some high yield junk which is up but not enough to offset what is happening in oil.

I am not sure what I want to do about my long oil positions. I am not considering putting new money to work though. If I wasn't underwater I might consider buying like with 1/3 of capital here. The thing about oil is a lot of crazy stakeholders and when shit goes down the price spikes back up so it's hard to imagine a volatility scenario that gets SCARY bad where OIL also remains depressed.

On the flipside, the fracking stuff is in trouble because of funding is drying up and it's not a consolidated industry at all. Bunch of cowboys out west, Dakotas and Texas and not as many deep pockets as people might imagine. The loans are drying up and are probably already dry.

Go with your gut brah. Buy high, sell low. They only play you have is to double down.

commodities don't fall this rapidly for no reason, it's either

a) market manipulation by the producers (opec/us) = it will go even lower

b) a rapid decrease in consumption caused by economic meltdown, we just don't know where yet = it will go way lower

c) mgrunnin managed to con Goldman Sachs and JP Morgan and is shorting oil at 1:1000 margin = lock down your diplomat retainers while they're cheap

a) market manipulation by the producers (opec/us) = it will go even lower

b) a rapid decrease in consumption caused by economic meltdown, we just don't know where yet = it will go way lower

c) mgrunnin managed to con Goldman Sachs and JP Morgan and is shorting oil at 1:1000 margin = lock down your diplomat retainers while they're cheap

Is pressure on russia the reason for the low oil prices? It makes sense, and the timing is perfect with the holiday shopping season.

Maybe you got the point, it's a price manipulation to damage Russia and it's a great thing.

I strongly hope this trend will keep for the next year putting the oil price near its real value ($40), then the global ecommerce will see the real boom.

I think I just learned more in this thread than my entire economics class in college.

i learned that i need to buy oil stocks right now. But I didn't learn what kind

It's not looking like a good time to buy the dip. I am closed 80% of oil related positions. Moved some stops up also. This looks like a mess coming, maybe not this week or even this month. But it is coming.

http://www.zerohedge.com/news/2014-...ore-crude-fire-oil-prices-can-go-lower-longer

http://www.zerohedge.com/news/2014-...ore-crude-fire-oil-prices-can-go-lower-longer

not yet, it will drop at least 20 to 25% unless someone blows something up. Watch out for PUTIN. The west want to punish Russia or box it into a corner.

The Saudis want to kill the American oil boom. If you have investments in the shale oil boom states you should consider selling now.

At a certain price level most of those FRACKING oil setups will all start going out of business, and that might be a time to consider buying.

You should be investing in food production and surviving outside of the GRID, if you know what I mean!

You're willing to underwrite a short CL position from here? 25% riskless profits! Jan CL futures are at 56.

Read this article for a pretty easy to read explanation for why everything has played out the way it has.

OPEC (mainly due to Saudi Arabia) decided not to cut back on oil production.

OPEC (mainly due to Saudi Arabia) decided not to cut back on oil production.

Read this article for a pretty easy to read explanation for why everything has played out the way it has.

OPEC (mainly due to Saudi Arabia) decided not to cut back on oil production.

thanks for the link. I've never heard of this Vox, but they seem to be doing some solid writing over there.

Maybe you got the point, it's a price manipulation to damage Russia and it's a great thing.

I strongly hope this trend will keep for the next year putting the oil price near its real value ($40), then the global ecommerce will see the real boom.

It has nothing to do with Russia, and everything to do with The US being the largest single oil and natgas producer. OPEC's "lifting" costs are in the teens... while the marginal shale suppliers in the US are in the $60-80s. The large (shale) players have shale lifting costs in the $40s. OPEC can afford this war of attrition. Shale will always be at least twice as costly to extract.

OPEC have zero upstream costs as well. Look at supplies at Cushing and tanker utilization.

imo this situation needs to finish itself first before Oil is worth looking at again.

If it keeps going North, Poo-tin will have a twitchy finger over the big red button.

If it keeps going North, Poo-tin will have a twitchy finger over the big red button.

I bought 500 shares of NKA today, they are sitting on a lot of cash with a book value of $6+

I think its a good buy, well will see what happens ...

valuations go out the window in a real fear/bear market.

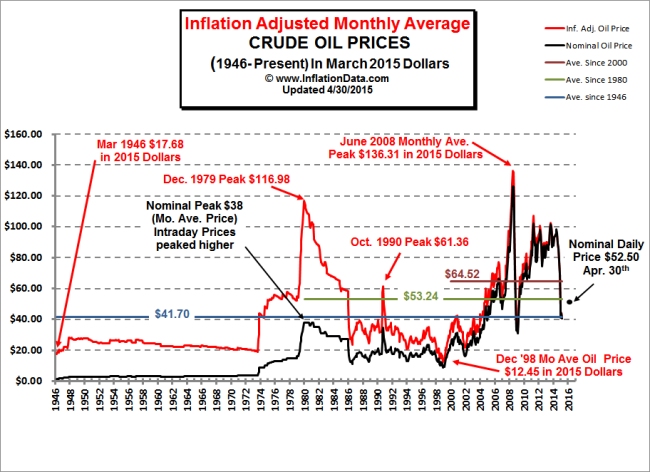

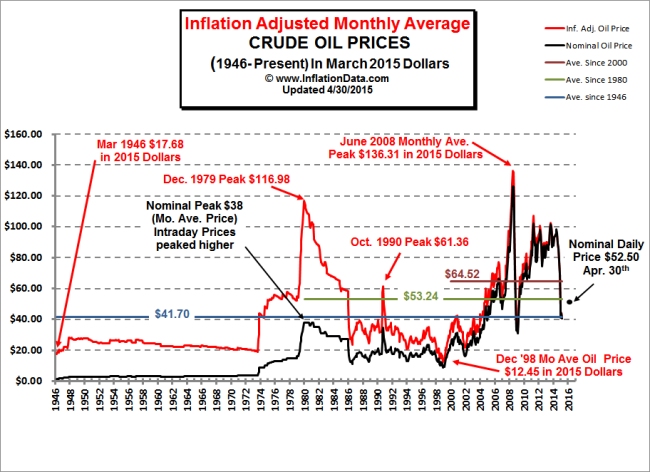

Looking for a repeat of the late 80's.

These high prices are entirely Gov't made.

Ya'lls charts are not long term enough.

These high prices are entirely Gov't made.

Ya'lls charts are not long term enough.

looked into that, where do you see the cash? seems like a great dividend buy if you just look at the surface but below that, I don't see them being able to pay this and debt accrued.I bought 500 shares of NKA today, they are sitting on a lot of cash with a book value of $6+

I think its a good buy, well will see what happens ...