Public Debt is all the obligations of the federal government to everyone outside the federal government (states, institutions, etc)

Total Public Debt is with the government included.

China owns the most securities of the US because they "loaned" us the money by buying our "securities".

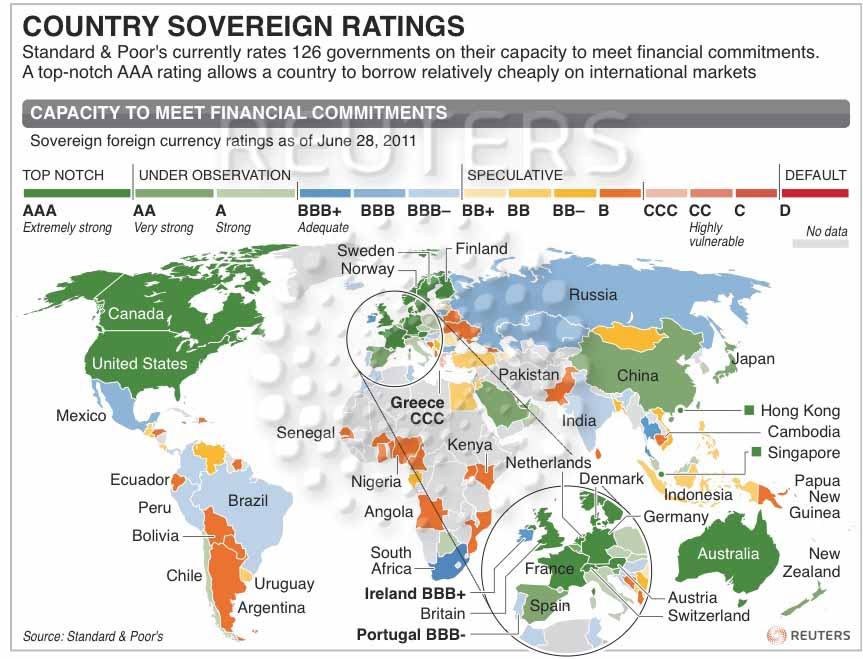

"Foreigners hold about 47 percent of US public debt. And yes, the largest foreign holder here is China – but only by a hair. Chinese investors are owed 9.8 percent of US debt. Next comes Japan, at 9.6 percent, and the United Kingdom, at 5.1 percent.

Oil exporting nations as a group, including Saudi Arabia, Oman, the United Arab Emirates, etc., account for about 2.6 percent of US debt. Brazil has 1.8 percent. The rest is split among lots of other countries.

So if anybody tells you that Americans work for China now, since they hold all our T-notes and can yank our fiscal chain, tell them that’s an exaggeration."

National debt: Whom does the US owe? - CSMonitor.com

Lots of hysteria here. I do laugh when the ratings agencies threaten to downgrade US Treasuries. Oh yeah Moody your opinion matters to me. Like I'm gonna buy Chinese yuan or Russian roubles.

Prem's getting big in US Treasuries UPDATE 2-Fairfax sees Treasuries as solid long-term bet | Reuters

He's a contrarian who has money than, um, everybody on wicked fire combined like ten times over.

You guys keep drawing conclusions from what the numbskulls on CNN and Fox fart out of their backsides. Look elsewhere for enlightenment.

Last edited: