Gas prices are high because a few years ago market speculators ran the prices of Crude barrels up.

Since Big Oil, Bush, and Cheney had vested interest in the price of Crude, they set the precident by keeping it at above $2.50/gallon even after the speculators were slammed by the MSM months later when the prices of everything shot up due to the ramiphications of high costs of transport and shipping.

This of course resulted in very happy shareholders due to an exponential increase in profits. Now, since shareholders enjoy seeing even higher profit margins each quarter, they couldn't very well lower the price of refined gas when the market speculators allowed the prices of crude below $80/barrel again could they? No.

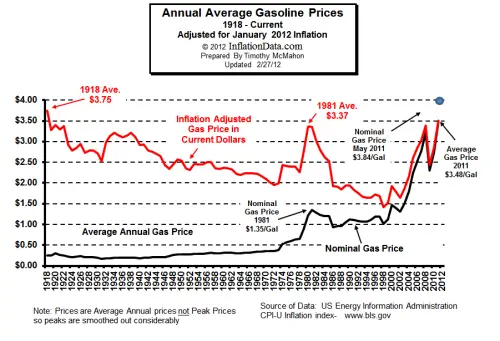

This is why gas hasn't gone back down to fluctuate around $1.50 like it was since the 80's through the early '00's. People don't want to lower their profit margins, even though it would greately benefit the economy as a whole.

It's not just Big Oil, it's like this in the Food industry as well with the prices of Bread, Cheese, Meat, Milk, etc. Once as large Manufacturer sets a precident of keeping supply at a certain rate, the others in the market will do the same and it becomes the norm.