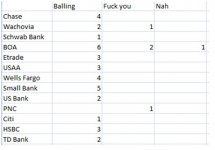

What Bank do you like/work with?

- Thread starter ThatSwissIMGuy

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

HSBC is great.

I've had my business accounts with a local bank for nearly 5 years and they were always a pain to deal with - the simplest things like sending a wire required an in-person visit to the branch and the tellers were usually useless or clueless.

Switched to HSBC about two month ago after they opened a branch across the street and couldn't be happier with them . Capable online banking platform (ugly, but capable) , no wire transfer fees and excellent customer service.

I've had my business accounts with a local bank for nearly 5 years and they were always a pain to deal with - the simplest things like sending a wire required an in-person visit to the branch and the tellers were usually useless or clueless.

Switched to HSBC about two month ago after they opened a branch across the street and couldn't be happier with them . Capable online banking platform (ugly, but capable) , no wire transfer fees and excellent customer service.

Most banks that I've dealt with will waive your FIRST overdraft, if you explain the situation to them.

SEFCU refused to waive anything, even though there was plenty of money in the account, just in the Checking instead of the Savings.

I'm considering Citi card. I have a CC with them and have been reasonably happy with it.

They called me up and informed me about the bounced payment mentioned above which my bank didn't and were really nice about it. Still charged me 50$ in fees though...

What are your experiences with them?

They called me up and informed me about the bounced payment mentioned above which my bank didn't and were really nice about it. Still charged me 50$ in fees though...

What are your experiences with them?

TD Bank (formerly Commerce bank)

mostly in the NJ/NY/PA area...great customer service...rarely have any fees and are always nice...

We have plenty of them up here...(Mass, NH, Maine) TD Banknorth, although I just switch to B.O.A after 8 years with TD banknorth. I think they just changed to TD Bank though.

Why are so many of you guys with BOA?

I just talked to them and their incoming wire fee is 12$

If you're on weekly's, you're paying them $576 per year just for fucking fees...

I just talked to them and their incoming wire fee is 12$

If you're on weekly's, you're paying them $576 per year just for fucking fees...

BOA? I paid over $350 couple months ago cause of overdrafts. I've got like 6 or 7 trasactions and each one was like $10 and they charged for $35 for each transaction. Oh, and luckly though they generously waived 1 transaction due to the fact that i'm their loyal customer.

Good. I would have recommended Citibank, until I noticed they were charging me $10 per overdraft, and HSBC never did that. There's only the normal interest charge for overdraft payments.

My business checking was Wamu, and now it's Chase. I had no complaint, but don't know how much I'll like the new bank.

Only 10 though? Most banks typically charge 35 or so for an overdraft if you don't cover the balance by end of business day. (or within 5 days on the Bank of America business account).

BOA? I paid over $350 couple months ago cause of overdrafts. I've got like 6 or 7 trasactions and each one was like $10 and they charged for $35 for each transaction. Oh, and luckly though they generously waived 1 transaction due to the fact that i'm their loyal customer.

Overdraft fees are not uncommon for banks, many charge them, so labeling one bank as bad because you made several transactions in a day when you didn't have the funds is a bit overzealous. Though I wish there was a way to simply say "I don't want overdraft protection" so that your debit card simply says denied when it goes over funds since its either that or responsibly budgeting your balance.

I hit overdraft twice on my BOA account (one time Vonage automatically charged me on a day I wasn't expecting, the other time wife made a small purchase without checking the balance), but both times as long as I made a deposit before 4pm the same day (or the next day if it was already after 4 that day), I didn't have to pay an overdraft fee, and the business account allows you 5 days to resolve before you get hit with an overdraft fee, most banks I had in the past automatically added 25-35$ the moment you overdrafted.

At least it's not like 5/3rd bank that charges you 5$ on top of the initial 35$ for every day your account is negative.

I have pre-approved overdraft protection at both banks. HSBC simply pays the overdraft then begins charging interest on the overdraft. Citibank charges $10 for the overdraft payments, in addition to the overdraft interest.Only 10 though? Most banks typically charge 35 or so for an overdraft if you don't cover the balance by end of business day. (or within 5 days on the Bank of America business account).

I have pre-approved overdraft protection at both banks.

Exactly what she said. I'm approved for £500 on overdraft. They just charge interest on that amount. If I go over that amount there is a £55 per month fee, plus the interest.

I got the overdraft protection after the first two times I took too much money out at an ATM machine or on a purchase with my debit card and incurred their £55 penalty. Back home that would never happen... no money in your account, no money from the bank machine. Not so in Europe. They'll let you have the money then ass rape you with penalties.

I primarily bank with NatWest offshore in Gibraltar but have several other bank accounts and lines of credit here, there, and elsewhere.

Overdraft fees are not uncommon for banks, many charge them, so labeling one bank as bad because you made several transactions in a day when you didn't have the funds is a bit overzealous. Though I wish there was a way to simply say "I don't want overdraft protection" so that your debit card simply says denied when it goes over funds since its either that or responsibly budgeting your balance.

I hit overdraft twice on my BOA account (one time Vonage automatically charged me on a day I wasn't expecting, the other time wife made a small purchase without checking the balance), but both times as long as I made a deposit before 4pm the same day (or the next day if it was already after 4 that day), I didn't have to pay an overdraft fee, and the business account allows you 5 days to resolve before you get hit with an overdraft fee, most banks I had in the past automatically added 25-35$ the moment you overdrafted.

At least it's not like 5/3rd bank that charges you 5$ on top of the initial 35$ for every day your account is negative.

I agree, but here's where the customer service comes in. None of my banks ever let me know I hit overdraft and I only check my balance every 3 days or so. The overdraft happened because google charged me unexpectadly and another bill came in I didn't expect. Had the bank called me up and said: "Hey Dude you are in overdraft, please balance it out or we'll charge you" it would have been fine. But they didn't. They said nothing and the credit card charged again 3 days later as they usually do, leading to another fee because my bank couldn't take the time to call me.

I get fraud allerts every two or three months or so on my citi credit card. They once called me about a $15 (!!!) transaction they thought might be fraudulent. THAT is customer service.

Chase -

here's why

1. Scored 5 accounts with them ( 4 personal and 1 business ) - each have 30k a day spending limits on each of my debit cards ( I use these for my AM costs )

1a. Cash Back or Rewards at 1.5%. Yeah I know Amex is 2% and that Chase has on all there papers they only do 1%, but if you a big enough customer you can get 1.5%

2. Sapphire Card - Works like Amex Back with no pre set spending limit and all the benfits, Sapphire is only 1% though rewards. I mostly use my debit, then use Sapphire for other things.

3. Branches have a lot of power, so if you get problems with Chase in general you can schmooze over your branch manager and get anything you want.

4. Most secure bank financially in the USA that I know of. Multiple sources confirm this.

5. Branches everywhere, since they bought out WaMu.. I can go almost anywhere in the USA and be in a branch.

here's why

1. Scored 5 accounts with them ( 4 personal and 1 business ) - each have 30k a day spending limits on each of my debit cards ( I use these for my AM costs )

1a. Cash Back or Rewards at 1.5%. Yeah I know Amex is 2% and that Chase has on all there papers they only do 1%, but if you a big enough customer you can get 1.5%

2. Sapphire Card - Works like Amex Back with no pre set spending limit and all the benfits, Sapphire is only 1% though rewards. I mostly use my debit, then use Sapphire for other things.

3. Branches have a lot of power, so if you get problems with Chase in general you can schmooze over your branch manager and get anything you want.

4. Most secure bank financially in the USA that I know of. Multiple sources confirm this.

5. Branches everywhere, since they bought out WaMu.. I can go almost anywhere in the USA and be in a branch.

Okay I just called HSBC since you guys were saying a lot of good stuff.

The phone service SUCKS BALLS

The menu is retarded, I couldn't get a real person for like 10min and the person I got didn't know anything and was obviously in India with a bad British accent.

Monthly Fees on every account regardless of balance is $3

Wire In Cost are $15

And contrary to what you guys are saying, they are actually charging $35 per over drafting transaction

Doesn't sound very good to me but might be cause I don't have a huge account with them.

The phone service SUCKS BALLS

The menu is retarded, I couldn't get a real person for like 10min and the person I got didn't know anything and was obviously in India with a bad British accent.

Monthly Fees on every account regardless of balance is $3

Wire In Cost are $15

And contrary to what you guys are saying, they are actually charging $35 per over drafting transaction

Doesn't sound very good to me but might be cause I don't have a huge account with them.

On second thought, anyone work with any Swiss banks in the US? So UBS, CS etc for personal banking, not investing?